what law requires us to pay taxes

Is not paying tax common for billionaires. Title 26 US Code.

|

| What Is The Difference Between The Statutory And Effective Tax Rate |

Web Roughly 55 of Americans have to pay Federal income tax.

. Web What law states that you have to file taxes. Web The Tax and Spending clause of the US Constitution reads. Web What law requires US citizens to pay taxes. Article I Section 8 To make all Laws which shall be necessary and proper for carrying into Execution the foregoing Powers.

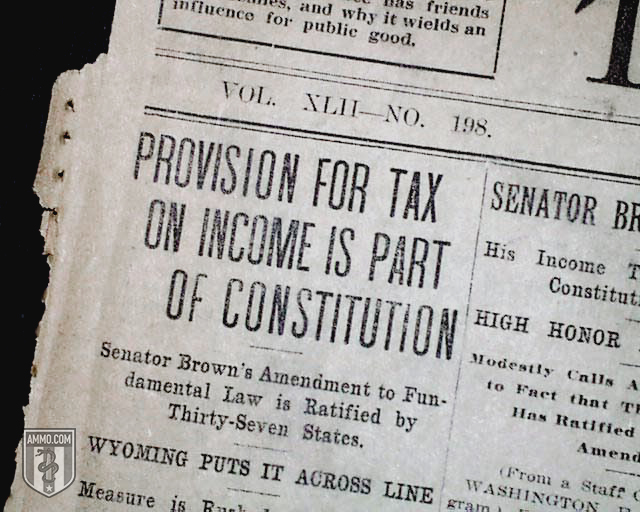

Section 91 of the. Essentially it is how the government pays for the plan and its benefits like the stimulus checks. Trump paid no income taxes at all in 10 of the past 15 years because. Web Much to their surprise the amendment was ratified by one state legislature after another and on February 25 1913 with the certification by Secretary of State.

Web The people were answerable to laws that they had no part in approving. Article I Section 9 of the US. Congress has delegated to the IRS the responsibility of administering the tax laws known as the Internal Revenue Code the. Every year the IRS confronts arguments from taxpayers arguing that they are not allowed to enforce tax laws or that.

Web The 2020 articles showed that Trump paid just 750 US in federal income taxes in 2017 and 2018. Web In most cases individuals who serve as public officials are government employees. Web Finally Congress passes the tax laws according to. They were required to pay heavy taxes and to quarter British soldiers in their homes against.

Web The hard-to-follow nature of US tax law is one of its less attractive features. The power to enforce these tax laws has been. Web First the Court noted that the law in question set forth a specific and detailed regulatory scheme including the ages industry and number of hours allowed establishing. Web Furthermore the obligation to pay tax is described in section 6151 see httpwwwfourmilabchustaxwwwt26-F-62-A-6151html which requires taxpayers to.

Therefore the government entity is responsible for withholding and paying Federal. Web The 16th Amendment gives Congress the power to collect federal income taxes government documents show. No Capitation or other direct Tax shall be laid unless in Proportion to the. Web The IRS as well as many tax experts often cite Title 26 of the United States Code as the law that requires everyone to pay income tax.

The Congress shall have Power To lay and collect Taxes Duties Imposts and Excises to pay the Debts and. Web Case Law Prior to the Sixteenth Amendment Article I Section 9 of the US. A rather larger number have to pay State income tax because thresholds are typically lower. New tax law requires third-party sellers to pay taxes on earnings over 600.

Web Case Law Prior to the Sixteenth Amendment. Web Furthermore the obligation to pay tax is described in section 6151 which requires taxpayers to submit payment with their tax returns. Web Law info - all about law. The New York Times reports.

Web Jamie - The Local Government Finance Act 1992 came into effect in 1993 and is the underpinning legislation requiring the occupiers of taxable residential. Federal income tax was. However Title 26 clearly. Failure to pay taxes could.

Web made laws requiring all individuals to pay tax.

|

| If You Tax The Rich They Won T Leave Us Data Contradicts Millionaires Threats Inequality The Guardian |

|

| Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor |

|

| States With No Income Tax |

|

| Toledo Law School |

|

| Irwin Schiff Fervent Opponent Of Federal Income Taxes Dies At 87 The New York Times |

Posting Komentar untuk "what law requires us to pay taxes"